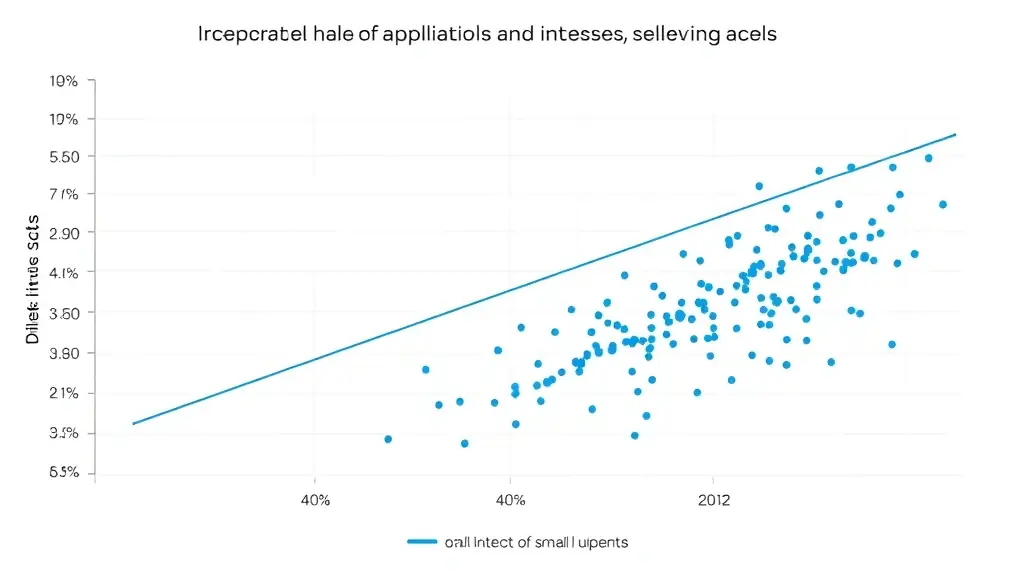

Small businesses are facing increasing challenges as interest rates continue to rise. Higher borrowing costs make it more expensive for small businesses to finance operations, impacting their ability to invest in growth and expansion. This is particularly concerning for startups and small businesses that rely heavily on loans for capital. The rising interest rates are also impacting consumer spending, which is a crucial factor for small businesses that rely on consumer demand. Reduced consumer spending can lead to decreased sales and revenue, further straining the financial health of small businesses. Government policies and support programs can play a crucial role in mitigating the impact of rising interest rates on small businesses. Providing access to affordable financing options and offering tax incentives can help small businesses navigate these challenges. The long-term impact of rising interest rates on small businesses remains to be seen, but proactive measures can help them adapt and thrive.

Sustainable Practices Gaining Momentum in the Manufacturing Sector

The manufacturing sector is increasingly adopting sustainable practices, driven by consumer demand and environmental regulations.